SBI PO (Probationary Officer) is an exam for Officer cadre posts conducted by the Institute of Banking Personnel Selection (IBPS) which is an autonomous body that receives the mandate from the State Bank of India. The Officer post is a senior or one-level up post than the Bank Clerk post in a prestigious banking career.

Table of Contents

SBI PO Exam

SBI PO Exam is directed by IBPS (Institue of Banking Personnel Selection) through a standard Common Recruitment Process (CPR). During this enrollment procedure, an incorporated test is directed for all the trying applicants. The assessment is going to be two-level for instance the net assessment is going to be held in two stages, Online Preliminary and Online Main. Up-and-comers who will qualify in Online Preliminary Examination and shortlisted should show up for Online Main Examination. Shortlisted up-and-comers in the Online Main assessment will in this manner be required a Group Exercise and Interview.

Significant focuses on SBI PO test qualification, dates, and test design are clarified in this article. In any case, competitors should deliberately peruse promotions by downloading them straightforwardly from the SBI Website or SBI Career Website.

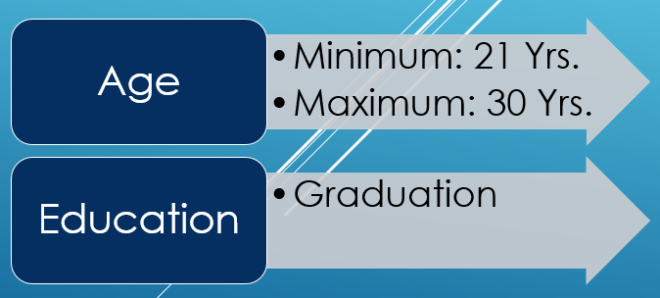

Eligibility Criteria

The above image shows the Eligibility Criteria for SBI PO aspiring candidates.

Age Relaxation

Below are maximum age relaxation:

- Scheduled Caste/Scheduled Tribe: Maximum age relaxation is 5 Yrs.

- Other Backward Classes (Non-Creamy Layer): Maximum age relaxation is 3 Yrs.

- Persons With Disabilities: Maximum age relaxation is 15 Yrs.

- Persons ordinarily domiciled in the State of Jammu & Kashmir during the period 01.01.1980 to 31.12.1989: Maximum age relaxation is 5 Yrs.

- Ex-Serviceman: Maximum age relaxation is 5 Yrs.

Educational Qualification

A Degree (Graduation) in any discipline from any College or University recognized by the Govt. Of India or any proportionate capability perceived as such by the Central Government. The up-and-comer must have a substantial Mark-sheet/Degree Certificate that he/she is an alumni on the day he/she enrolls and shows the level of imprints acquired in Graduation while enrolling online.

Other Similar Exams: IBPS PO and IBPS SO

Important Dates for SBI PO

Below are the important dates of SBI PO Exams of 2019:

| Activity | Tentative Dates |

| On-line registration including Editing/ Modification of Application by candidates | 02.04.2019 to 22.04.2019 |

| Payment of Application Fee/ Intimation Charges | 02.04.2019 to 22.04.2019 |

| Download of call letters for online Preliminary Examination | 3rd week of May 2019 onwards |

| Online Preliminary Examination | 8th, 9th, 15th & 16th June 2019 |

| Result of Online Preliminary Examination | 1st week of July 2019 |

| Download of Call letter for Online Main Examination | 2nd week of July 2019 |

| Conduct of Online Main Examination | 20th July 2019 |

| Declaration of Result of Main Examination | 3rd week of August 2019 |

| Download of Call Letter for Group Exercises & Interview | 4th week of August 2019 |

| Conduct of Group Exercises & Interview | September 2019 |

| Declaration of Final Result | 2nd week of October 2019 |

Exam Fees for SBI PO

Application Fees/ Intimation Charges Payable from 02.04.2019 to 22.04.2019 (Online payment), both dates inclusive, shall be as follows:

- Rs. 125/- (intimation charges only) for SC/ST/PWD candidates.

- Rs. 750 /- (App. Fees. including intimation charges) for all others

Bank Transaction charges for Online Payment of application fees/ intimation charges will have to be borne by the candidate

Exam Pattern of SBI PO

Below is the structure of the online SBI PO Prelims Exam:

| Sr. No. | Name of Test | No. of Questions | Marks | Duration |

| 1 | English Language | 30 | 30 | 20 Minutes |

| 2 | Quantitative Aptitude | 35 | 35 | 20 Minutes |

| 3 | Reasoning Ability | 35 | 35 | 20 Minutes |

| Total | 100 | 100 | 1 Hour |

Determination rules for Main Examination: Category shrewd legitimacy rundown will be drawn based on the total imprints scored in the Preliminary Exam. There will be no sectional cut-off. Up-and-comers are 10 times the number of total openings (approx.) in every classification will be shortlisted for Main Examination from the highest point of the above legitimacy list. The following is SBI Mains test design:

| Sr. No. | Name of the Test | No. of Questions | Maximum Marks | Duration |

| 1 | Reasoning & Computer Aptitude | 45 | 60 | 60 Minutes |

| 2 | Data Interpretation & Analysis | 35 | 60 | 45 Minutes |

| 3 | General / Economy / Banking Awareness | 40 | 40 | 35 Minutes |

| 4 | English Language | 35 | 40 | 40 Minutes |

| Total | 155 | 200 | 3 Hours | |

| 5 | Letter & Essay Writing | 2 | 50 | 30 Minutes |

| Total | 250 |

Selection measures for Group Exercise and Interview: Category insightful legitimacy rundown will be drawn based on the total imprints scored in the Main Examination. There will be no sectional cut-off. Applicants numbering up to multiple times (approx.) of the classification insightful opening will be shortlisted for the Group Exercise and Interview from the highest point of the class shrewd legitimacy list subject to an up-and-comer scoring the base total qualifying score.

Group Exercises (20 marks) & Interview (30 marks).

SBI PO Exam Syllabus

SBI PO Exam Syllabus or SBI Probationary Officer Exam Syllabus is listed in this article, after extensively analyzing previous years’ SBI PO exams question papers. However, the SBI PO syllabus is not specified in the SBI PO advertisement, for which candidates find it difficult to cover all topics relevant to the SBI PO Exam preparation.

Negative Marking

Negative marks for Wrong Answers (Applicable to both – Online Preliminary and Online Main Examination). There will be negative marks for wrong answers set apart in the Objective Tests. For each question for which an off-base answer has been given by the competitor one fourth or 0.25 of the imprints doled out to that question will be deducted as punishment to show up at remedied score. On the off chance that an inquiry is left clear, for example no answer is set apart by the applicant, there will be no punishment for that question.

Final Selection

The imprints acquired in the Preliminary Examination (Phase-I) won’t be included in setting up the last legitimacy list for choice. Just the imprints acquired in Main Examination (Phase-II), both in the Objective Test and the Descriptive Test, will be added to the imprints got in GE and Interview (Phase-III) for setting up the last legitimacy list. The competitors should qualify both in Phase-II and Phase-III independently.

Imprints made sure about by the up-and-comers in the Main Examination (out of 250 imprints) are changed over to out of 75 checks and Group Exercises and Interview scores of the competitor (out of 50 imprints) are changed over to out of 25 imprints. The last legitimacy list is shown up in the wake of accumulating (out of 100) changed over characteristics of Main Examination and Group Exercises and Interview. The choice will be produced using the top legitimacy positioned competitors in every class.

Aftereffects of the up-and-comers who fit the bill for Main Examination, Group Exercise, and Interviews just as the last select rundown will be made accessible on the Bank’s website.

FAQs

Minimum age required for the SBI PO exam?

Minimum of 21 years of age is required to apply for the SBI PO exam.

The maximum number of attempts for the SBI PO exam?

There’s no maximum number of attempts for candidates for appearing in SBI PO exam. However, candidates must satisfy all eligibility criteria before applying for the exam.

Maximum age limit for the SBI PO exam?

The candidate should not be older than 30 Years of age. However, there are age relaxation granted which candidates need to check before applying.

Is there a negative marking in SBI PO Exam?

Negative marks for Wrong Answers (Applicable to both – Online Preliminary and Online Main Examination), 0.25 marks will be deducted for every wrong answer from.

What is the Salary of SBI PO?

Starting basic pay for SBI PO is Rs. 27,620/- (with 4 advance increments) in the scale of 23700-980/7-30560-1145/2-32850-1310/7-42020.

Prepare & Practice

Test yourself with a similar set of questions asked in SBI PO Click Here.